Bound Metal Additive Manufacturing Technologies Will Grow at Nearly Twice the Market Rate Through 2029 According to Latest SmarTech Analysis Report

12 December 2019

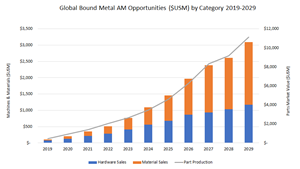

CROZET, Va., Dec. 12, 2019 (GLOBE NEWSWIRE) -- Bound metal additive manufacturing technologies, which have gained significant interest and investment dollars over the last three years and being developed by the likes of HP, Desktop Metal, Markforged, GE Additive, ExOne, and many more, are now expected to achieve close to twice the rate of growth compared to the overall metal additive manufacturing market over the next ten years, according to the latest from SmarTech Analysis. As the leading provider of market intelligence and analysis services to the additive manufacturing industry, SmarTech has recently completed its latest long term industry forecast specific to this emerging set of exciting metal additive technologies, available now in the form of an expansive database and supplementary report covering market opportunities in bound metal hardware, materials, and parts production activity. While the overall metal AM hardware market is expected to continue to grow annually at a rate of nearly 20 percent through 2029, bound metal deposition and metal binder jetting technologies -which collectively make up the bound metal printing AM segment - are projected to grow at rates of 30 percent and 35 percent across the same period. For more information on the report go to: About the Report: This latest database and report from SmarTech covers the rapidly evolving bound metal additive manufacturing market, analyzing opportunities from each of the two primary sub-segments of this industry both as individual opportunities and as a collective opportunity for those companies looking to capitalize on the benefits of offering solutions utilizing both primary bound metal printing methods. The database covers hardware sales, material shipments and sales for metal powders consumed by these technologies, as well as the projected production volume and market impact of parts produced by these technologies across various markets by their functional roles and projected leading applications. This study is the first of its kind to address opportunities specific to this emerging high interest area of metal additive manufacturing, where metal AM leaders and newcomers alike are expected to commercialize various new printing platforms and systems over the next two years. The report also features a special analysis of the impacts of commercialization of bound metal printing technologies are expected to have on the markets for high end industrial sintering furnaces, greatly expanding opportunities for this type of equipment beyond what is traditionally used today. From the Report: About SmarTech Analysis Since 2013 SmarTech Analysis has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. Our company has a client roster that includes the largest 3D printer firms, materials firms and investors in the 3DP/AM sector. For more details on our company go to www.smartechanalysis.com Contact A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d451cf16-bae6-417c-b291-3d93ea34554b

https://www.smartechanalysis.com/reports/bound-metal-additive-manufacturing-market/

Robert Nolan

(804) 938-0030

[email protected]Bound Metal Additive Manufacturing Market Outlook

Global Bound Metal AM Opportunities ($USM) by Category 2019-2029